1、Effective Duration copyright THC 2003.All rights reserved by Thomas Ho Company,NY,NY.reference number40classification#30701InstructionsVersionV3levelbasicUse data-table to generate the bond performance profile when spot yield changes other things being equal.publication dateMay-03authorHanyang Finan

2、cial Engineering Lab.affiliationHanyang Universityinputemail addressleesbhanyang.ac.krlast revised dateDec-03outputreferencesCh.3 of The Oxford Guide to Financial Modeling by Thomas S.Y.Ho and Sang Bin Lee,2004,Oxford University PressDescriptionsfinancial model classBond Markets:The Bond Modelissuer

3、/modelercorporationsmodel typeDurationsrisk sourcesinterest raterisk distributionN/Aeconomic assumptionscomparative staticstechnical assumptionsm=2key wordsLinksdatahttp:/www.federalreserve.gov/financial models7.Bond Arithmetic,8.Bond ModelInputscompounding frequency(m)2bond maturity(years)100T10 wi

4、th 0.5 step sizeprincipal100coupon rate(annual compounding)0 spot yield(shift amount)0key rate0Key rate 0 means parallel shift.year00.511.52spot curve(semi-annual compounding)0.060.060.06shifted curve0.060.060.060.060.06cash flow0000PV(CF)0000bond price55.367575Outputs spot yield(shift amount)-0.000

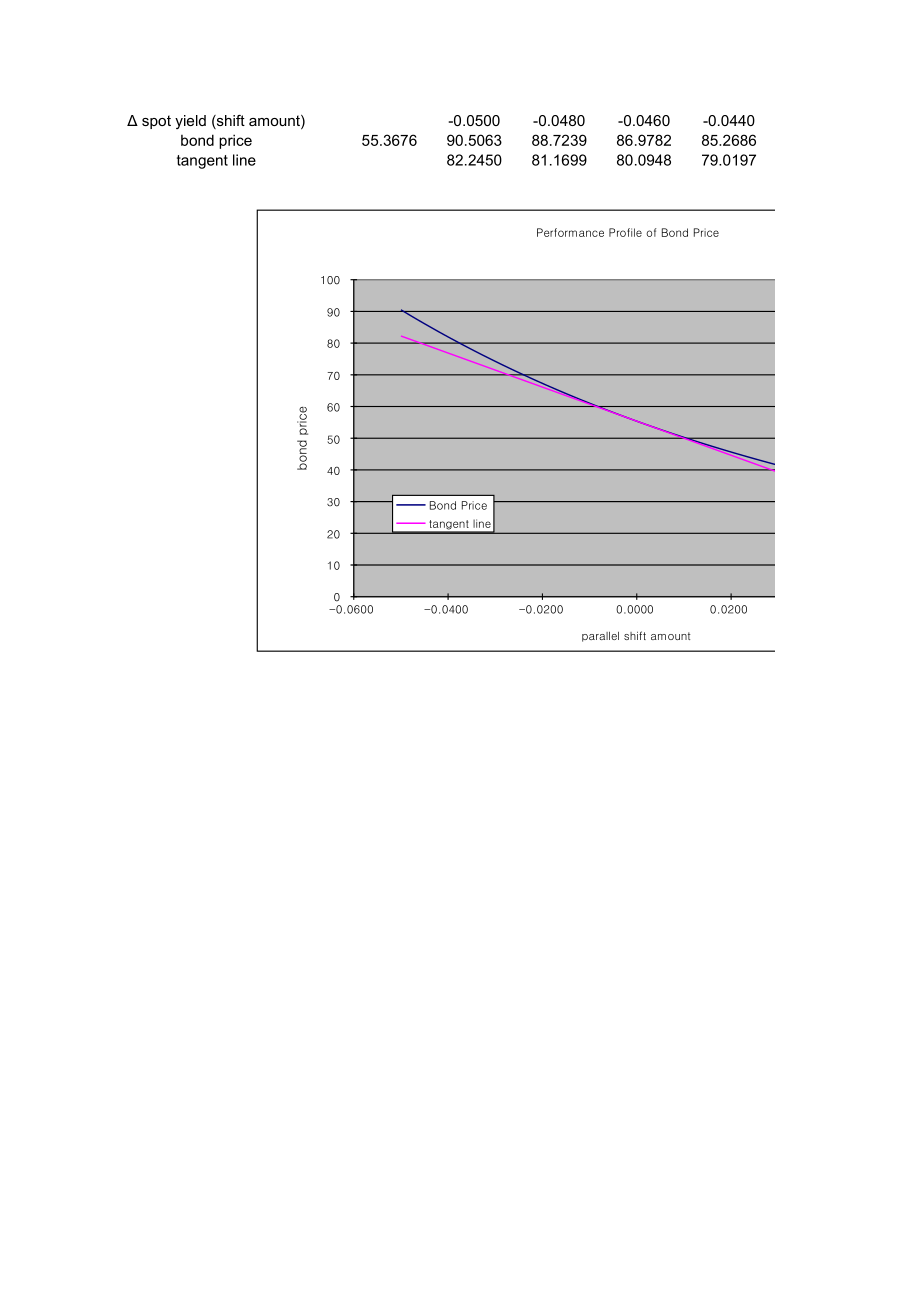

5、10.00000.0001bond price55.367655.421455.367655.3138effective duration(numerical value)9.7087=-(P(r+)-P(r-)/(2P(r)effective duration of zero-coupon bond9.7087=T/(1+r0.5(T)/2)(closed form)portfolio duration9.7087 spot yield(shift amount)-0.0500-0.0480-0.0460-0.0440bond price55.367690.506388.723986.978

6、285.2686tangent line82.245081.169980.094879.0197Performance Profile of Bond Price0.0600 0.0400 0.0200 0.0000-0.0200-0.0400-0.0600 0 10 20 30 40 50 60 70 80 90 100 parallel shift amountbond priceBond Pricetangent spot curve,principal,coupon rate,shift amount of spot rate,key rateeffective duration2.5

7、33.544.555.560.060.060.060.060.060.060.060.060.060.060.060.060000000000000000 copyright THC 2003.All rights reserved by Thomas Ho Company,NY,NY.Use data-table to generate the bond performance profile when spot yield changes other things being equal.Ch.3 of The Oxford Guide to Financial Modeling by T

8、homas S.Y.Ho and Sang Bin Lee,2004,Oxford University Press-0.0420-0.0400-0.0380-0.0360-0.0340-0.0320-0.0300-0.028083.594381.954480.348378.775277.234575.725374.247072.799177.944676.869675.794574.719473.644372.569271.494170.4190Performance Profile of Bond Price0.0600 0.0400 0.0200 0.0000-0.0200-0.0400

9、-0.0600 0 10 20 30 40 50 60 70 80 90 100 parallel shift amountbond priceBond Pricetangent line6.577.588.599.5100.060.060.060.060.060.060.060.060.060.060.060.0600000001000000000 55.367575-0.0260-0.0240-0.0220-0.0200-0.0180-0.0160-0.0140-0.012071.380769.991468.630467.297165.991164.711663.458162.230269

10、.343968.268867.193766.118665.043563.968462.893361.8182-0.0100-0.0080-0.0060-0.0040-0.00200.00000.00200.004061.027159.848458.693757.562256.453755.367654.303453.260660.743159.668058.592957.517856.442755.367654.292553.21740.00600.00800.01000.01200.01400.01600.01800.020052.238851.237750.256649.295248.35

11、3247.430046.525345.638752.142351.067249.992148.917047.841946.766845.691744.61660.02200.02400.02600.02800.03000.03200.03400.036044.769843.918343.083842.265941.464340.678639.908639.153843.541542.466441.391340.316239.241138.166037.090936.01580.03800.04000.04200.04400.04600.04800.050038.414137.688936.97

12、8236.281535.598634.929134.272934.940733.865632.790531.715430.640329.565228.4901Effective Duration copyright THC 2003.All rights reserved by Thomas Ho Company,NY,NY.reference number40classification#30701InstructionsVersion1.0levelbasicUse data-table to generate the bond performance profile when spot

13、yield changes other things being equal.publication dateMay-03authorHanyang Financial Engineering Lab.affiliationHanyang Universityinputemail addressleesbhanyang.ac.krlast revised dateDec-03outputreferencesCh.3 of The Oxford Guide to Financial Modeling by Thomas S.Y.Ho and Sang Bin Lee,2004,Oxford Un

14、iversity PressDescriptionsfinancial model classBond Markets:The Bond Modelissuer/modelercorporationsmodel typeDurationsrisk sourcesinterest raterisk distributionN/Aeconomic assumptionscomparative staticstechnical assumptionsm=2key wordsLinksdatahttp:/www.federalreserve.gov/financial models7.Bond Ari

15、thmetic,8.Bond ModelInputscompounding frequency(m)2bond maturity(years)100T10 with 0.5 step sizeprincipal1000coupon rate(annual compounding)0 spot yield(shift amount)0key rate0Key rate 0 means parallel shift.year00.511.52spot curve(semi-annual compounding)0.060.060.06shifted curve0.060.060.060.060.0

16、6cash flow0000PV(CF)0000bond price553.67575Outputs spot yield(shift amount)-0.00010.00000.0001bond price553.6758554.2136553.6758553.1385effective duration(numerical value)9.7087=-(P(r+)-P(r-)/(2P(r)effective duration of zero-coupon bond9.7087=T/(1+r0.5(T)/2)(closed form)portfolio duration9.7087 spot yield(shift amount)-0.0500-0.0480-0.0460-0.0440bond price553.6758905.0629887.2385869.7823852.6864tangent line822.4504811.6995800.9485790.1975Performance Profile of Bond Price0.0600 0.0400 0.0200 0.00

41Effective Duration V3.xls

41Effective Duration V3.xls

搜弘文库所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

搜弘文库所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

财务报表数据分析模板.xls

财务报表数据分析模板.xls

财务数据报表分析ppt模板.pptx

财务数据报表分析ppt模板.pptx

財務分析模板.doc

財務分析模板.doc